Contents

- Message from the Commissioner

- Strategic framework

- Compliance Strategy

- Commitments

- Outcomes and measures

- Conclusion

- Download a PDF version

Message from the Commissioner

Maximising compliance

The SRO’s purpose is to provide customers with quality revenue management services that are fair, efficient and benefit all Victorians.

To achieve this mission, we need to continue building confidence in the Victorian taxation system.

Our Compliance Division is made up of Investigations Branches in Melbourne and Ballarat as well as the Landholder Acquisitions Branch.

However, every single member of our organisation plays a vital role in fostering a culture of compliance through education, assistance and enforcement. Within this context, compliance is everything we do at the SRO – and we do it effectively.

We operate under the premise that most of our customers will pay the right tax at the right time if they are aware of their obligations, and the vast majority of the revenue we collect comes from voluntary compliance.

We will continue to maximise voluntary compliance by providing comprehensive advice, education, assistance and information to help customers understand their obligations.

But when customers deliberately choose not to comply, our expert investigative teams will actively pursue those avoiding tax and apply the full force of the law.

Our Compliance Strategy 2023–27 is made up of 4 strategic goals: the first 2 outline key actions to enhance voluntary compliance, while the second 2 focus on detecting, deterring and penalising non-compliance.

One of the SRO’s 5 strategic goals is to maximise compliance – and our shared commitment to this strategy will ensure we achieve this ambition.

Paul Broderick

Commissioner of State Revenue

Strategic framework

This Compliance Strategy is informed by the objectives of the SRO Strategic Plan, in particular Strategic Goal 5 — Maximise Compliance. Our planning process provides the framework for translating our 2023–27 Strategic Plan into goals and objectives that guide our work for the next 4 years.

Compliance Strategy

Overview

The pursuit of Strategic Goal 5 – Maximise Compliance in the SRO’s Strategic Plan 2023–27 is to protect government revenue and encourage voluntary compliance. We will do this by building community confidence in a Victorian taxation system that is fair, efficient and widely complied with.

The key objectives of this strategic goal are to maximise revenue collection while minimising non-compliance. Our overarching approach is to encourage and support voluntary compliance and to detect and deter non-compliance.

We do this in a number of ways, including by fostering a culture of compliance through education, assistance and enforcement. We seek to provide clear and effective information enabling customers and their representatives to identify and understand their obligations.

In support of this, we provide systems and channels to make it easy for customers to comply and have adopted a ‘payment thinking’ focus to ensure that customers who choose to do the right thing are given the right information to pay the right amount of tax at the right time.

For those customers that have not satisfied their obligations or have chosen not to comply, we use sophisticated processes and tools to identify, investigate and action non-compliance. We also apply proportionate sanctions and measures to recover taxes (including grants that are administered by the SRO) and discourage future instances of non-compliance.

This strategy recognises the SRO’s multifaceted approach to compliance and that it is the focus of all we do at the SRO and is not limited to the detection and enforcement activities of the Compliance Division.

Meaning of compliance

Compliance is the degree to which customers observe and act in accordance with applicable Victorian taxation laws.

Voluntary compliance refers to customers meeting their tax obligations by paying the right amount of tax at the right time. Whereas non-compliance is the degree to which customers fail to do so and is represented by the total amount of tax owing that is not paid on time.

In order to reduce non-compliance, various investigative methods and tools are used to detect and assess tax liabilities after the obligation to pay the tax has arisen.

Our compliance methodology

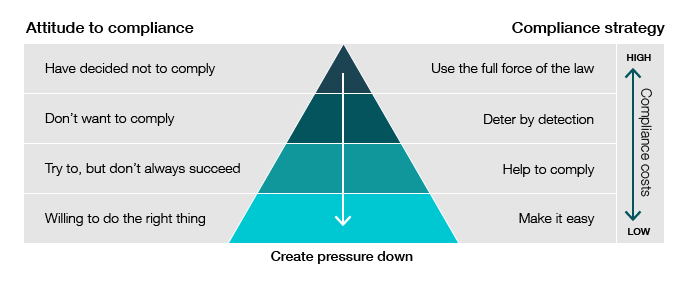

We recognise that the majority of our customers do the right thing at the right time and take the necessary steps to meet their obligations. A lesser number of customers want to comply but don’t always succeed, and an even smaller number make the choice not to comply.

As a result, our compliance methodology draws on the Australian Taxation Office's compliance model depicted in the below diagram. This model recognises a continuum of customer attitudes to compliance, extending from being willing to do the right thing at the base, to having decided not to comply at the peak. The model also recognises that customer behaviour is influenced by a range of factors, including the actions of the revenue authority.

To encourage our customers to operate at the base of the pyramid, we seek to understand what motivates their choices and behaviours around compliance. This assists us in tailoring our systems and interventions to influence their decisions and behaviours in a positive way by making voluntary compliance easy and non-compliance unattractive.

The following 4 strategic goals set out the strategies and activities we undertake to maximise compliance. Strategic Goals 1 and 2 concern voluntary compliance whereas Strategic Goals 3 and 4 address non-compliance.

Strategic Goal 1 — Making compliance easy

Make it easy and inexpensive for customers to recognise when they have a liability and how to pay it.

We will:

- Engage with Government in the design and implementation of new taxation legislation to ensure it is easy for customers to understand and comply with from the start.

- Provide a comprehensive website with detailed information about state taxes and the circumstances in which a tax liability will arise.

- Provide online decision tools and calculators that enable customers to determine if they are liable for tax and the amount of tax payable.

- Deliver seminar and webinar programs on topical tax issues. Webinar programs enable customers, advisers and members of the public to participate in sessions online while seminars are delivered in a face-to-face environment.

- Employ highly skilled and knowledgeable staff committed to educating and assisting customers to identify, understand and meet their taxation obligations.

- Use technology to provide access to modern and efficient electronic channels, including the convenience of 24/7 self-service options.

- Provide digital and online payment options that allow customers to pay their taxes electronically from any location at any time.

- Provide systems that allow customers to set up automated instalment payment plans for certain taxes.

- Promote the use of self-explanatory and interactive smart forms and communications through our online portals.

- Provide customers with timely and up-to-date information.

- Utilise customer surveys and expand the Voice of the Customer Program to drive ongoing improvements in service delivery, including our range of e-business transactions.

Key actions

- Provide clear and effective communication channels to customers, enabling them to readily identify and pay a liability when it arises.

- Ensure that website materials and webinar programs provide information that is clear, concise and easy to understand.

- Design processes, systems and engagement approaches that make it easy and inexpensive for customers to comply.

- Deliver an annual education program and undertake other activities that build community awareness and confidence in a Victorian taxation system that is fair, efficient and benefits all Victorians.

Strategic Goal 2 — Helping customers comply

Foster collaborative and positive relationships with customers and professional advisers that build community confidence in the Victorian taxation system.

We will:

- Engage with peak bodies and other organisations to target areas for education and build community awareness and confidence in the Victorian taxation system.

- Provide support and online services that assist customers and professional advisers with their enquiries and concerns promptly.

- Provide a subscription service for customers and professional advisers to receive updates on state taxes, including legislative and/or administrative changes.

- Run targeted early intervention and mail-out programs to alert customers approaching taxable thresholds or the end date by which they need to satisfy the eligibility criteria of their approved grant, exemption or concession.

- Continue delivering our private ruling service where customers can ask the Commissioner to review their circumstances or a particular transaction and advise whether there is or will be a liability to tax.

- Publish public rulings to address general areas of uncertainty on the interpretation and application of state tax legislation.

- Provide customers with communication channels to voluntarily disclose past liabilities and obtain concessional rates of penalty tax and interest.

- Resolve customer interactions at the earliest and most efficient point to prevent duplication and rework.

- Adopt a ‘payment thinking’ focus to encourage customers to pay their tax liabilities at the earliest interaction point.

Key actions

- Build relationships with peak bodies and other organisations to increase community awareness and confidence in the Victorian taxation system.

- Ensure that materials and publications aimed at assisting customers to better understand their obligations are readily available and accessible on our website.

- Provide customers with communication channels to obtain certainty on undisclosed past liabilities to tax, including an assessment policy that limits the period of retrospectivity.

- Continue delivering our public and private ruling services to address general and customer specific interpretation issues in a timely manner.

- Publish information on our website about common compliance errors, including how customers can voluntarily disclose similar errors to mitigate penalty tax and interest consequences.

Strategic Goal 3 — Detecting and deterring non-compliance

Use data matching techniques to identify and assess non-compliance and publish our compliance approach to deter non-compliance and encourage compliance.

We will:

- Publish a clearly defined penalties policy that encourages and rewards voluntary compliance and penalises non-compliance.

- Regularly review the compliance risks for each revenue line to target areas (and customers) of greatest exposure. From time to time, this may require us to focus on particular industries or market sectors.

- Adopt an intelligence led approach to compliance activities. In most cases this means using electronic tools to identify non-compliance.

- Monitor media reports and use a wide range of data sources in our data matching techniques to identify non-compliance. To the extent permitted by law, this includes data exchanged with other revenue offices, government agencies and third parties such as financial institutions, utility companies and vendors or other parties involved in a transaction.

- Identify and secure new data sources and technology to assist in detecting non-compliance.

- Improve our understanding of the cause of non-compliance and identify opportunities to improve voluntary compliance.

- Share information on identified or suspected areas of risk with other state and territory taxing authorities to ensure we identify and respond to emerging revenue risks in a timely manner.

- Employ skilled investigators and continually invest in their training, knowledge and skills.

- Ensure SRO decision letters and notices of decision appropriately inform and educate customers.

- Aim to achieve high strike rates with our compliance programs, thereby engaging only with those customers who are non-compliant. This approach minimises the imposition of distractions on compliant customers.

- Encourage public participation in compliance efforts by providing tip-off channels for reporting suspected non-compliance anonymously.

- Provide customers with an opportunity to voluntary disclose tax liabilities during an investigation to obtain concessional rates of penalty tax and interest.

- Pursue overdue payments in a timely manner and provide customers with appropriate payment plans and options when they cannot meet their tax obligations.

- Undertake surveys to improve and refine our customer experience and compliance outcomes.

Key actions

- Publish our compliance approach to demonstrate our commitment to fairness and our compliance programs for the forthcoming year.

- Broaden our data sources and technologies to maximise our success rate in identifying and targeting non-compliance.

- Provide taxpayers with an opportunity to voluntarily disclose, either before or during an investigation, to access concessional rates of penalty tax and interest.

- Target particular industries or market sectors identified as posing the greatest risk to revenue leakage to discourage non-compliance and recover unpaid taxes.

Strategic Goal 4 — Enforce the law against deliberate non-compliance

Apply the full force of the law to customers who deliberately evade complying with their obligations under the Victorian taxation system.

We will:

- Publish a clearly defined retrospective assessment policy that does not limit the period of assessment of past tax liabilities where the customer’s actions demonstrate an intentional disregard of the law.

- Participate in the interjurisdictional Phoenix Taskforce and actively pursue illegal activities in Victoria.

- Use statutory powers to obtain information from customers and third parties when required.

- Impose and collect penalties commensurate with the customer’s level of culpability.

- Pursue overdue payments and use appropriate enforcement measures, including:

- the registration of charges against land subject to unpaid land tax or reclaimed First Home Owner Grants

- wind-up proceedings against corporations trading while insolvent and bankruptcy proceedings against individuals

- recovery proceedings in the Victorian Magistrates’ Court or other courts of competent jurisdiction

- prosecution, where warranted.

- Identify and recommend legislative and policy solutions to counter detected avoidance schemes and arrangements.

Key actions

- Use the full force of the law, including our statutory powers to achieve compliance where a customer’s actions demonstrate deliberate avoidance or evasion of their tax obligations and liabilities.

- Impose and collect penalty tax and/or interest which reflects a customer’s level of culpability.

- Pursue overdue payments in a timely manner and apply enforcement measures where appropriate.

Commitments

As SRO staff, we are all committed to assisting our customers comply with Victorian taxation laws.

We also:

- take pride in our work.

- relate to customers in a fair, respectful and professional manner.

- deliver quality services to our customers.

- do what we say we’ll do and act with integrity and honesty when the unexpected occurs.

- make the best use of our resources.

- take responsibility for our decisions and actions.

- act in accordance with all policies and procedures.

- strive to continuously improve our services, knowledge and skills.

- are open to change and new ideas from all sources.

- recognise and value diverse backgrounds and perspectives.

- work together to maintain a positive workplace culture and deliver positive outcomes to customers and the Victorian community.

Outcomes and measures

Expected outcomes

- Increase voluntary compliance by improving systems and interventions that seek to influence customer behaviour in a positive way.

- Increase strike rates on compliance programs through improved data quality and enhanced matching techniques.

- Identify and address new and emerging compliance risks through enhanced communication and engagement with industry, peak bodies and other state and territory taxing authorities.

Measures

- Revenue forecasts and targets, including all relevant balanced scorecard measures.

- Agreed actions in Branch Plans.

Conclusion

The SRO approach to maximising compliance is supported by activities that build awareness and trust within the community, provide education and assistance at each point of a customer’s journey and enforces the law when required.

The goals set out in this strategy are best achieved through follow-up actions. We will build accountability by implementing activities, measuring their success and continuously evaluating and improving what we do.

This strategy outlines our priorities between now and 2027. Our commitment to the 4 goals in this strategy will enable our people to contribute to the SRO’s strategic goals, which ultimately deliver benefits to all Victorians.