Grouping

Businesses may be grouped if they share ownership, control or staff.

Related corporations

Corporations are grouped under s70 of the Payroll Tax Act 2007 (the Act) where they are related bodies corporate within the meaning of s50 of the Corporations Act 2001 (Cth). This is commonly referred to as a holding/subsidiary relationship.

A corporation will be grouped with another corporation for the purposes of s70 if it:

- holds more than 50% of the issued share capital of that other corporation

- controls the composition of the board of directors of that other corporation, or

- can cast, or control the casting of, more than 50% of the votes which can be cast at a general meeting of that other corporation.

For the purposes of this section, a group includes those corporations in a direct holding/subsidiary relationship as well as corporations with a:

- common holding company, or

- common ultimate holding company.

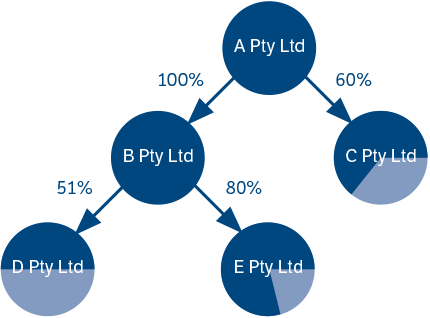

Example

- A constitutes a group with both B and C. A is the holding company of both B and C because it holds more than 50% of the issued shares of each company.

- B, D and E constitute a group because B is the holding company of both D and E.

- All of the companies shown on the diagram constitute a group because A is the common ultimate holding company.

A group under this section is a mandatory group. Under s79(3) of the Act, the Commissioner must not exclude a corporation from such a group, even if the business carried on by that corporation is independent of, and not connected with, the business of other corporations in the group. However, this provision will not be applied to group a corporation which only acts as a trustee of a trust and is not trading in its own right, even though it forms a holding/subsidiary relationship with another corporation. The grouping provisions apply to corporations regardless of where they are located. This is particularly relevant to Australian subsidiaries of an overseas parent corporation. The grouping provisions could apply to group these corporations even if the Australian subsidiaries are unaware of each other’s existence. For this reason, a corporation owned by an overseas parent should contact their parent corporation to determine whether there are other subsidiaries operating in Australia.

Employees performing duties for another business

An employer will be grouped with the person(s) carrying on another business or other businesses where:

- one or more employees of the employer perform duties for one or more businesses carried on by the employer and one or more persons

- one or more employees of the employer are employed solely or mainly to perform duties for one or more businesses carried on by one or more other persons

- one or more employees of an employer performs duties for one or more businesses carried on by one or more other persons, being duties performed in connection with, or in fulfilment of the employer’s obligation under an agreement, arrangement or undertaking for the provision of services to any of those persons.

The application of these grouping provisions was considered by the Supreme Court in Commissioner of State Revenue v Liquid Rock Constructions Pty Ltd [2012] VSC 329. The court held that the other business or businesses to which an employee of an employer is performing duties, must have some practical ability to direct that employee as to the manner of the performance of those duties.

Example

CDE Manufacturing Pty Ltd is a manufacturer of widgets. XYZ Administration Pty Ltd provides marketing, accounting, clerical and secretarial services to CDE. In providing those services, the employees of XYZ are under the general direction of CDE.

Therefore, CDE and XYZ constitute a group because the employees of XYZ perform duties for or in connection with the business of CDE.

Commonly controlled businesses

If a person or set of persons has a controlling interest in each of 2 businesses, the entities who carry on the businesses make up a group.

Controlling interest

A group exists where a person or a set of persons has a controlling interest in each of 2 businesses. In such circumstances, it is the entities conducting the businesses that are grouped and not the persons who have the controlling interest in the businesses.

What constitutes a controlling interest depends on the type of entity operating the business. Under s72 of the Act, a person or a set of persons is considered to have a controlling interest:

- Where a business is conducted by a corporation, that person or set of persons:

- is the director of that corporation and can exercise more than 50% of the voting power at a directors’ meeting

- is able to instruct or influence a director(s) who can exercise more than 50% of the voting power at a directors’ meeting, or

- can exercise or influence the exercise of more than 50% of the voting power attached to any class of issued voting shares of the corporation.

- Where a business is conducted by either an incorporated or unincorporated body, that person or set of persons:

- constitutes more than 50% of the board of management of the corporate or unincorporated body carrying on that business, or

- can control the composition of the board.

- Where a business is conducted by a partnership, that person or set of persons:

- owns, whether beneficially or not, more than 50% of the capital of the partnership, or

- is entitled to more than 50% of the profits of the partnership.

- Where the business is conducted by one person, that person is the sole owner of the business.

- Where in the case of a set of persons, the persons are together, as trustees, the sole owners of the business.

- Where a business is conducted by a trust, that person or set of persons is the beneficiary in respect of more than 50% of the value of the interests in the trust.

In relation to trusts:

- Interests in a trust include, among other things, entitlements to profits or capital distributions.

- Any person who may benefit from a discretionary trust is deemed to be a beneficiary of more than 50% of the value of the interests in the trust and therefore has a controlling interest in that trust.

Indirect relationships

A controlling interest for the purposes of the grouping provisions need not be direct. Control may be held through another entity to which a person is related or in which a person has a controlling interest. This can occur:

- If corporations are related under s50 of the Corporations Act 2001 (Cth), a corporation is deemed to have a controlling interest in any business in which a related corporation has a controlling interest.

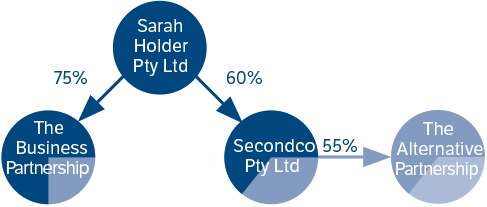

Example

Sarah Holder Pty Ltd and Secondco Pty Ltd are related under s50 of the Corporations Act 2001 (Cth) because Secondco Pty Ltd is a subsidiary of Sarah Holder Pty Ltd. These 2 companies have controlling interests in 2 businesses, The Business Partnership, and The Alternative Partnership, respectively.

As Sarah Holder Pty Ltd and Secondco Pty Ltd are related, Sarah Holder Pty Ltd is deemed to have a controlling interest in the business in which Secondco Pty Ltd has a controlling interest (that is, The Alternative Partnership). Therefore, The Business Partnership and The Alternative Partnership constitute a group because Sarah Holder Pty Ltd has a controlling interest in The Business Partnership and is deemed to have a controlling interest in The Alternative Partnership.

- If a person has a controlling interest in one business and the person who carries on that business has a controlling interest in another business, then that first person is also deemed to have a controlling interest in the second business.

Example

Ian Vestor has a controlling interest in Business A. Company A, which carries on Business A, has a controlling interest in Business B. Ian Vestor is therefore also deemed to have a controlling interest in Business B via his controlling interest in Business A.

- Where a trustee of a trust has a controlling interest in a business, a beneficiary of that trust will be deemed to have a controlling interest in that business if that beneficiary is a beneficiary in respect of more than 50% of the value of the interests in that trust.

Example

Ben Robinson stands to benefit from the Robinson Family Discretionary Trust. He is therefore deemed to be a beneficiary of more than 50% of the value of the interests in that trust and as such is deemed to also have a controlling interest in the business carried on by Trading Co. Pty Ltd.

Same person owning two or more businesses

Where 2 businesses are conducted by the same entity or person, there is no need to consider the application of the grouping provisions.

In such cases, there is only one employer and the wages paid for each business must be combined in returns lodged by that employer. The same applies to a trustee owning 2 businesses, except where the trustee owns the businesses on behalf of 2 different trusts, in which case the grouping provisions would need to be considered.

Tracing of interests

Under the tracing provisions, an entity will be grouped with a corporation in which the entity has a controlling interest.

A controlling interest exists if the entity has a direct interest, an indirect interest or an aggregate interest in the corporation – and the value of that interest exceeds 50%.

Entities

An entity is a person or set of associated persons which, under s73(4) of the Act, includes:

- a person and his/her spouse or domestic partner

- natural persons where the relationship between them is that of parent and child or siblings

- related corporations within the meaning of the Corporations Act 2001 (Cth)

- a natural person and a private company where the natural person is a majority shareholder or director of the company or of another private company that is a related body corporate of the company within the meaning of the Corporations Act 2001 (Cth)

- a natural person and a trustee where the natural person is a beneficiary of the trust (not being a public unit trust scheme) of which the trustee is a trustee

- a private company and trustee where the company or a majority shareholder or director of the company is a beneficiary of the trust (not including a public unit trust scheme) of which the trustee is a trustee

- natural persons if they are partners in a partnership

- private companies if common shareholders hold a majority interest in each private company

- trustees if beneficiaries are common to the trusts (not including a public unit trust scheme) of which they are trustees

- a private company and a trustee where a related body corporate of the company, within the meaning of the Corporations Act 2001 (Cth), is a beneficiary of the trust (not including a public unit trust scheme) of which the trustee is a trustee.

Tracing interests in corporations

A direct interest in a corporation exists where an entity can directly or indirectly exercise, control or influence the voting power attached to voting shares in the corporation. The value of the direct interest is the proportion of the corporation’s voting shares, expressed as a percentage, that the entity can exercise, control or influence.

An indirect interest exists where an entity has a direct interest in a corporation, that is the directly controlled corporation, which is linked to another corporation.

A corporation is linked to the directly controlled corporation if it is part of a chain of corporations where each link in the chain has a direct interest in the next corporation in the chain. The value of the indirect interest is calculated by multiplying the value of the entity’s direct interest in the directly controlled corporation, with the value of each direct interest forming the link.

Example

- Entity has a direct interest in Corporation A.

- Corporation A has a direct interest in Corporation B.

- Corporation B has a direct interest in Corporation C.

- Corporations B and C are linked to Corporation A.

Therefore, Entity has an indirect interest in both Corporations B and C.

The value of Entity’s indirect interest in Corporation B is 80% x 70% = 56%.

The value of Entity’s indirect interest in Corporation C is 80% x 70% x 40% = 22.4%.

Therefore, under the tracing of interests provisions, the entity forms a group with corporations A and B because its direct interest in Corporation A and its indirect interest in Corporation B both exceed 50%.

An aggregate interest is the sum of an entity’s direct and indirect interests in a corporation and occurs when an entity has:

- a direct and indirect interest in a corporation

- more than one indirect interest in a corporation.

The value of the aggregate interest is the sum of the value of the entity’s direct interest in the corporation and the value of each indirect interest.

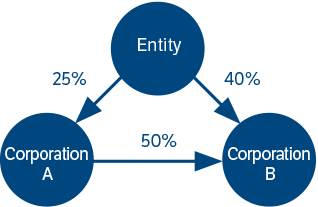

Example

- Entity has a direct interest in A (25%) and B (40%).

- Entity has an indirect interest in B (25% x 50% = 12.5%).

- Entity’s aggregate interest in B is 40% + 12.5% = 52.5%.

Entity therefore has a controlling interest in Corporation B. Entity and Corporation B form a group under the tracing of interests provisions.

Amalgamations

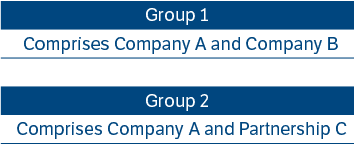

Where 2 or more groups exist and at least one member is common to each, those groups will, subject to the Commissioner’s discretion, be amalgamated and treated as one.

Example

Company A is common to each group.

Therefore, Group 1 and Group 2 will be amalgamated and companies A and B, and Partnership C, will form one group.

Where 2 or more members of a group, when considered together, have a controlling interest in a business, within the meaning of s72, all the members of the group and the person or persons who carry on the business together form a group.

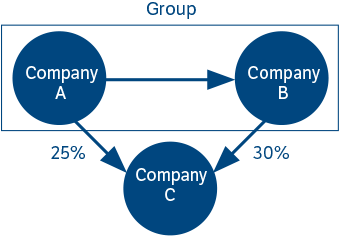

Example

- Company A and Company B form a group for payroll tax purposes.

- Company A has a 25% interest in Company C.

- Company B has a 30% interest in Company C.

- Company A and Company B together have a controlling interest, 55%, in Company C. The 3 companies form a group for payroll tax purposes.

Interstate groups

The grouping provisions apply to businesses regardless of where they operate. Accordingly, 2 businesses may be grouped even though one is located in Victoria and the other in another state.

This is relevant for the purposes of determining a group’s total Australian wages because it will have an impact on the amount of the approved deduction that the group is entitled to claim in Victoria.

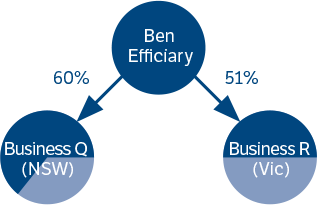

Example

Despite the fact that the 2 businesses are located in different states, Business Q and Business R will be grouped because Ben Efficiary has a controlling interest in each.

Exclusions from the grouping provisions

By necessity, the grouping provisions are very broad in their application. In recognition of this, the Act gives the Commissioner discretion to exclude a member from a group in certain circumstances.

The discretion is not available for members that are related corporations within the meaning of s50 of the Corporations Act 2001 (Cth).

This discretion is available only in relation to groups which arise as a consequence of:

- Use of common employees

- Commonly controlled businesses

- Tracing, or

- Amalgamation of groups with common membership.

The Commissioner may exclude a member from a group formed as a result of these grouping provisions if he is satisfied the business conducted by that member is independent of, and not connected with, the business conducted by any other member of the group. In considering the application of this discretion, the Commissioner considers:

- the nature and degree of ownership and control of the businesses

- the nature of the businesses

- any other relevant matters.

Commissioner’s discretion

The following, which are not in order of importance, are some of the practical considerations and questions the Commissioner considers when determining whether or not to exercise discretion to exclude a member from a group.

Trade between the businesses

- Are transactions occurring between the businesses?

- If yes, what is the purpose of those transactions?

- What is the level of trade between the businesses?

- Do the purchases of one of the businesses constitute a large proportion of the sales of the other business?

- Are these transactions conducted on normal commercial terms, or are discounts provided?

Sharing of resources between businesses

- Do the businesses share resources, including premises, staff, management and accounting services?

- If there is sharing of resources, is there any charge made?

- If there is a charge, is the charge reasonable given the type of resource shared and the level of sharing?

Common management of the businesses

- Is the same person or persons responsible for the day-to-day operation of the businesses?

- If so, are the operating decisions of one of the businesses made with the impact of such decisions on the other businesses in mind?

- Are the managers of the businesses controlled or obliged to follow the directions of another person(s)?

Common financial arrangements between the businesses

- Do the businesses have common financial arrangements?

- Have the businesses sought finance as a group from a financial institution?

- If yes, are there cross-securities for arrangements between the businesses?

- Are there loans between the businesses?

- If there are loans between the businesses, do written loan agreements exist?

- Is a reasonable rate of interest charged on the loans?

- Are regular repayments required?

Common customers of the businesses

- Is there a relationship between the customers of the businesses?

- Do the customers of one of the businesses automatically become customers of the other business(es)?

- Do the businesses provide complementary services to their customers?

- Is there a connection between the nature of the businesses?

- Does one of the businesses add value to goods or services provided by the other business?

The extent of the connection between the business owners

- Are the same people the owners of the businesses?

- Are the owners of the businesses closely related?

These factors are just some of the more common issues that the Commissioner considers when deciding whether to exercise discretion to exclude a member from a group. It is not an exhaustive list. Each case is considered on all its relevant facts. For more details, please refer to Revenue Ruling PTA-031v2.

Generally, the Commissioner exercises the discretion if he is satisfied that the:

- relationship between the businesses is not continuous, active and significant

- connections between the businesses are merely casual or irregular.

If there is any uncertainty about the application of the grouping provisions please apply in writing for a private ruling.

Registration requirements for groups

Grouping provisions apply to all entities irrespective of whether or not they are employers. Each member of the group must be registered individually and as part of the group.

Once registered, each group is allocated a unique registration number. Group changes, such as when entities begin and stop being part of a group, must be updated promptly in PTX Express.

Mental health and wellbeing surcharge

The mental health and wellbeing surcharge commenced from 1 January 2022. You must pay the surcharge if you pay Victorian taxable wages and your Australian wages exceed the first annual threshold of $10 million, with a first monthly threshold of $833,333.

You must also pay the additional surcharge if you pay Victorian taxable wages and your Australian wages exceed the second annual threshold of $100 million, with a second monthly threshold of $8,333,333.

If you are a member of a group, these thresholds apply at the group level and are claimed by the designated group employer.