Wagering and betting tax grouping

Entities may be grouped if they share ownership or common control.

Related corporations

Corporations are grouped under s41 of the Gambling Taxation Act 2023 (the Act) where they are related bodies corporate within the meaning of the Corporations Act 2001 (Cth). This is more commonly described as a holding/subsidiary relationship.

A corporation will be grouped with another corporation if it:

- holds more than 50% of the issued share capital of that other corporation,

- controls the composition of the board of directors of that other corporation, or

- can cast, or control the casting of, more than 50% of the votes which can be cast at a general meeting of that other corporation.

For the purposes of this section, a group includes those corporations in a direct holding/subsidiary relationship as well as corporations with a common:

- holding company, or

- ultimate holding company.

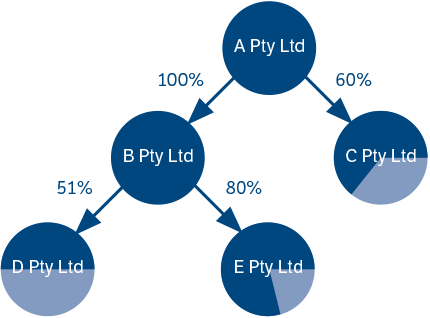

Example 1

- A constitutes a group with both B and C. A is the holding company of both B and C because it holds more than 50% of the issued shares of each company.

- B, D and E constitute a group because B is the holding company of both D and E.

- All of the companies shown on the diagram constitute a group because A is the common ultimate holding company.

This provision will not be applied to group a corporation which only acts as a trustee of a trust and is not trading in its own right, even though it forms a holding/subsidiary relationship with another corporation.

The grouping provisions apply to corporations regardless of where they are located. This is particularly relevant to Australian subsidiaries of an overseas parent corporation. The grouping provisions could apply to group these corporations even if the Australian subsidiaries are unaware of each other’s existence.

For this reason, a corporation owned by an overseas parent should contact their parent corporation to determine whether there are other subsidiaries operating in Australia.

Commonly controlled businesses

If a person or set of people has a controlling interest in each of 2 businesses, the people who carry on the businesses make up a group. Unlike payroll tax, 'business' is defined to mean the business of a wagering and betting entity, whether carried on by one person or 2 or more persons together.

Controlling interest

A group exists where a person or a set of persons has a controlling interest in each of 2 businesses. In such circumstances, it is the entities conducting the businesses that are grouped and not the persons who have the controlling interest in the businesses.

What constitutes a controlling interest depends on the type of entity operating the business. Under s42 of the Act, a person or a set of persons is considered to have a controlling interest:

- Where a business is conducted by a corporation, that person or set of persons:

- is the director of that corporation and can exercise more than 50% of the voting power at a directors’ meeting,

- is able to instruct or influence a director(s) who can exercise more than 50% of the voting power at a directors’ meeting, or

- can exercise or influence the exercise of more than 50% of the voting power attached to any class of issued voting shares of the corporation.

- Where a business is conducted by a partnership, that person or set of persons:

- owns, whether beneficially or not, more than 50% of the capital of the partnership, or

- is entitled, whether beneficially or not, to more than 50% of the profits of the partnership.

- Where the business is conducted by one person, that person is the sole owner of the business.

- Where, in the case of a set of persons, the persons are together, as trustees, the sole owners of the business.

- Where a business is conducted by a trust, that person or set of persons is the beneficiary in respect of more than 50% of the value of the interests in the trust.

In relation to trusts:

- Interests in a trust include, among other things, entitlements to profits or capital distributions.

- Any person who may benefit from a discretionary trust is deemed to be a beneficiary of more than 50% of the value of the interests in the trust and therefore has a controlling interest in that trust.

Indirect relationships

A controlling interest for the purposes of the grouping provisions need not be direct. Control may be held through another entity to which a person is related or in which a person has a controlling interest. This can occur:

1. If corporations are related under s50 of the Corporations Act 2001 (Cth), a corporation is deemed to have a controlling interest in any business in which a related corporation has a controlling interest.

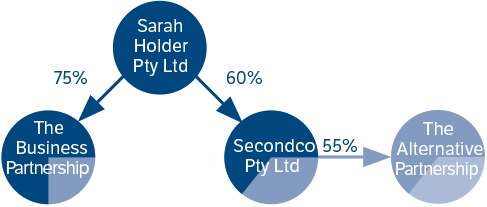

Example 2

Sarah Holder Pty Ltd and Secondco Pty Ltd are related under s50 of the Corporations Act 2001 (Cth) because Secondco Pty Ltd is a subsidiary of Sarah Holder Pty Ltd. These 2 companies have controlling interests in 2 businesses, The Business Partnership, and The Alternative Partnership, respectively.

As Sarah Holder Pty Ltd and Secondco Pty Ltd are related, Sarah Holder Pty Ltd is deemed to have a controlling interest in the business in which Secondco Pty Ltd has a controlling interest (that is, The Alternative Partnership). Therefore, The Business Partnership and The Alternative Partnership constitute a group because Sarah Holder Pty Ltd has a controlling interest in The Business Partnership and is deemed to have a controlling interest in The Alternative Partnership.

2. If a person has a controlling interest in one business and the person who carries on that business has a controlling interest in another business, then that first person is also deemed to have a controlling interest in the second business.

Example 3

Ian Vestor has a controlling interest in Business A. Company A, which carries on Business A, has a controlling interest in Business B. Ian Vestor is therefore also deemed to have a controlling interest in Business B via his controlling interest in Business A.

3. Where a trustee of a trust has a controlling interest in a business (whether carried on by another trust, a corporation or a partnership), a beneficiary of that trust will be deemed to have a controlling interest in that business if that beneficiary is a beneficiary in respect of more than 50% of the value of the interests in that trust.

Example 4

Trustee Co. Pty Ltd has a controlling interest in a business carried on by Trading Co. Pty Ltd. Ben Robinson stands to benefit from the Robinson Family Discretionary Trust. He is therefore deemed to be a beneficiary of more than 50% of the value of the interests in that trust and as such is deemed to also have a controlling interest in the business carried on by Trading Co. Pty Ltd.

Smaller groups subsumed by larger group – ‘amalgamation of groups’

When a person is a member of 2 or more groups, all the members of these groups constitute one group for wagering and betting tax purposes.

If 2 or more members of a group have together a controlling interest in a business, all the members of the group and the person carrying on the business together constitute a group.

No discretion to de-group

Please note that, unlike payroll tax, the Commissioner of State Revenue does not have discretion to exclude any member from a wagering and betting group.

Calculation of a group’s wagering and betting tax

Only one tax-free threshold can be claimed by the group for the relevant financial year. Tax is payable on the net wagering revenue, including GST, of a group according to the following formula:

15% × (aggregate amount of the net wagering revenue, including GST, of all members of the group – tax-free threshold)

Every member of the group, whether or not a wagering or betting entity, is jointly and severally liable to pay wagering and betting tax on the group’s net wagering revenue.

Groups must register with us online before the end of the first month in which they become liable.

Entity leaving or joining a group during a financial year

Given that the tax-free threshold is an annual threshold, special grouping rules apply when an entity leaves or joins a group during a financial year.

- Joining entity rule: where a tax-paying entity becomes a member of a group, the group's tax-free threshold will be reduced to zero. Where a non-paying entity becomes a member of a group, the group's tax-free threshold will remain unchanged, but the entity's net wagering revenue (NWR) accumulated before joining the group in the financial year will be aggregated in the group's aggregate net wagering revenue (ANWR).

- Leaving entity rule: where a group member leaves a group, the leaving entity's tax-free threshold for the remainder of the financial year will be reduced (to the maximum extent of zero) by its NWR accumulated during the group period.

Moving groups during a financial year

Where an entity transfers from a tax-paying group (Group 1) to another group (Group 2) during a financial year, the tax-free threshold for Group 2 will be reduced to zero and the net wagering revenue (NWR) accumulated by that entity while it was a member of Group 1 during the financial year will be transferred to Group 2’s aggregated net wagering revenue (ANWR).

Where an entity transfers from a non-tax-paying group (Group 1) to another group (Group 2) during a financial year, the tax-free threshold for Group 2 will remain unchanged and the NWR accumulated by that entity while it was a member of Group 1 during the financial year will not be transferred to Group 2’s ANWR.

Where a tax-paying bigger group breaks into multiple smaller groups during a financial year, each of the smaller group’s tax-free threshold is reduced to zero and the NWR accumulated by each member while it was a member of the big group in that financial year will not be transferred into the smaller group’s ANWR.

Where a non-tax-paying bigger group breaks into multiple smaller groups during a financial year, each smaller group is entitled to a $1,000,000 tax-free threshold, and the NWR accumulated by each member while it was a member of the big group in that financial year will be transferred into the smaller group’s ANWR.