Principal place of residence exemption

Your home may be exempt from land tax.

Key information

If you own a property in Victoria and it is where you live, you might not have to pay land tax on it. This is called the principal place of residence (PPR) exemption.

We usually identify your PPR based on information provided when you buy a property, such as through the Notice of Acquisition of an Interest in Land (NOA) form. If your conveyancer did not nominate your PPR details on the NOA, or if you are moving into another property you own, you will need to apply for the exemption.

If you are building or renovating a home that you plan to live in, but it is not nominated as your PPR on the NOA, you may still be eligible for an exemption. For the requirements and how to apply, read about the exemption for construction or renovation of a principal place of residence.

Sometimes, you need to let us know if your situation changes. For example, if you move out of your home or if the ownership of the property changes. If the exemption no longer applies and you do not tell us, you may have to pay land tax plus penalty tax and interest. We may issue retrospective assessments for prior years you are required to pay land tax on the property.

You can update details about property ownership and your PPR by calling us on 13 21 61.

Holiday homes do not qualify for the PPR exemption, even if you use them regularly.

Apply for a principal place of residence exemption

From 1 January 2026, certain owner-occupied land is exempt, if it:

- is valued less than $300,000

- contains a temporary residence, such as a caravan, tent or shed.

The exemption is targeted to owners who do not qualify for the PPR exemption because there is no building affixed to their land that meets the PPR exemption requirements. Write to us to apply for this exemption.

The requirements for the 'main residence' exemption from capital gains tax, which is administered by the Australian Taxation Office, are not the same as those for the PPR exemption. You may not be entitled to both.

Eligibility for the exemption

Owner occupied homes

Generally, you can only claim one PPR exemption anywhere in Australia at a time, although there are limited exceptions to this rule.

The PPR exemption does not apply to land owned by companies, owner corporations (formerly body corporates) and other organisations. This is true even if a shareholder or member of the company or organisation lives at the property.

It also does not apply to land owned by natural persons who occupy it as a PPR and are:

- trustees or beneficiaries of a trust (including an implied or constructive trust) to which the land is subject, or

- a unitholder in a unit trust scheme to which the land is subject.

In limited cases, land held by eligible trustees may still qualify.

Eligible trustees

This exemption is generally only available for land:

- owned by trustees of certain trusts, and

- used and occupied as the PPR of a vested beneficiary, who is a natural person with either a vested beneficial interest in the land (such as under a fixed trust) or the principal beneficiary of a special disability trust.

Trustees eligible for the PPR exemption also include trustees:

- of a fixed or bare trust, if a person lives in the home as their primary residence

- of a trust under a will, if someone lives in the home under a legal right to reside granted under the terms of the will or testamentary instrument

- appointed in accordance with a will for a life tenant who lives in the home as their main residence.

The exemption is not available for land owned by a trustee of a discretionary trust, a unit trust scheme or a liquidator. However, concessionary tax treatment is available if a trustee of a discretionary trust or a unit trust scheme nominates a beneficiary who lives in the home as their main residence. You can nominate a PPR or subsequent PPR beneficiary by filling out the LTX-Trust-19 form.

The exemption does not apply, if the vested beneficiary pays rent to live in the home held by a fixed trust.

For land held by fixed trusts or joint ownerships, the exemption can only apply to the share held by an owner or beneficiary who uses the land as their PPR.

The exemption is also not available for land owned by trustees of implied or constructive trusts.

A person with a qualifying disability

An exemption is available where land is owned by an immediate family member of a person with a qualifying disability and the land is used as a PPR by that person with a qualifying disability.

A special disability trust does not need to be set up to receive this exemption. The eligible trustees exemption (above) applies when a special disability trust has been set up and a principal beneficiary lives in the home as their PPR.

The exemption is only available from the 2024 land tax year onwards.

To be eligible for the exemption, these conditions must be met:

- The landowner is an immediate family member of the person with a qualifying disability. An immediate family member includes a natural parent, adoptive parent, step-parent, legal guardian, grandparent or sibling. Children are not included.

- The person with a qualifying disability has met the PPR occupancy requirements in the year preceding the tax year.

- No rent has been paid by, or on behalf of, the person with a qualifying disability for residing at the land as their PPR.

- The person has received a determination in writing from Services Australia or the Department of Veterans' Affairs that they meet the impairment of disability conditions for a special disability trust. The exemption can only apply in the land tax year following the approval date. However, if the approval date is in the 2024 calendar year, the exemption can still apply in the 2024 land tax year, as this is the first year for this new exemption.

Do not contact Services Australia for a determination unless you meet the conditions 1 to 3 above. Also check the eligibility criteria for the principal beneficiary of a special disability trust before you apply.

For help applying for a special disability trust, including getting assessed for the disability conditions in condition 4 above, contact Services Australia on 132 717. Further information on special disability trusts can be found on the Services Australia website.

Right to reside under a will or testamentary instrument

If a natural person lives in a home because they have been granted a right to live there under a will or testamentary instrument, these requirements must be met:

- immediately before the person was granted a right to live in the home, the land was the PPR-exempt land of the deceased

- the right was not granted or acquired in exchange for monetary consideration

- the person does not have another PPR in Australia.

Life estates

If a person who is granted a life estate under a will or other way uses and occupies that land as their PPR, the exemption is available.

Deceased estates

Where the individual owner or vested beneficiary who was using the land as their PPR dies, the exemption continues to apply until one of these events happens:

- 3 years have passed since the death of the individual owner or vested beneficiary (unless we approve a written request for a longer period in strictly limited circumstances)

- the interest of the individual owner or vested beneficiary is given to another person under a trust

- the land is sold or transferred.

Before the 2026 tax year, the exemption ends if the land is used to earn income following the death of the former owner or vested beneficiary.

From 1 January 2026, the income requirement applies differently. A partial PPR exemption may apply if income is earned from a substantial business activity or a separate residence after the owner’s death. This means the part of the land containing the PPR will remain exempt from land tax, and the part used to earn income will be taxable. In all other cases where income is earned from the land, the PPR exemption will not continue after the owner’s death.

Representatives should advise the SRO if they think a partial exemption applies, so the land can be assessed correctly.

This exemption does not apply after the death of the resident who lived in the home was:

- granted a right to live there in a will or similar legal document

- granted a life estate in possession

- a person with a disability (qualifying) who was living on land owned by an immediate family member.

Example

Jerry and Caroline are the personal representatives of Sam’s estate. Sam died in 2024. At the time of his death, Sam owned one property containing both his home and a granny flat that was rented out. The granny flat remains rented after Sam’s death.

For the 2025 tax year, the property is not eligible for a PPR exemption because it earns rental income.

From the 2026 tax year, a partial PPR exemption applies. This means the part of the property containing Sam’s home is exempt until the end of the PPR concessionary period. The part containing the granny flat is taxable until the end of the administration trust concessionary period.

Requirements of the exemption

To be eligible for the exemption, certain land and occupancy requirements must be met.

Land requirement

There must be a building on the land which is designed and constructed primarily for residential purposes and can lawfully be used as a place of residence. For newly built homes, this means the certificate of occupancy must be issued.

Structures like caravans, shipping containers or sheds do not meet this requirement unless they are approved for residential use, such as having an occupancy permit . If the land is classified as vacant and you are living in a temporary structure, the exemption may not apply.

The exemption is generally only available for one parcel of land that is your principal residence. Therefore, if you own more than one parcel of land and you live on each land during the year, only one can be your PPR.

This means that if you have other land in Australia that receives a PPR exemption, the Victorian land tax exemption will generally not apply.

If your PPR is a building built across more than one land that you own because it straddles the boundary of those lands, or if you live in an apartment with car parks or storage rooms/cages that comprise multiple property titles but together they constitute your PPR, then the exemption will apply to each of those lands.

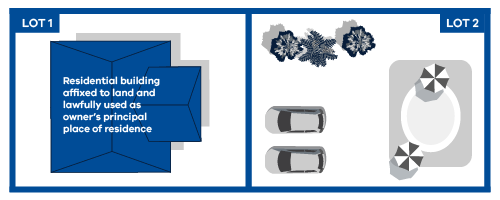

Example

Dimitri owns lot 1 and lot 2, which are next to each other on separate titles. His residence straddles both lots and therefore both lots are eligible for the exemption.

Occupancy requirement

Where the landowner is an individual owner or eligible trustee, that landowner or the vested beneficiary of the eligible trust must live on the land for at least 6 months from 1 July of the year before the assessment to be eligible for the exemption.

We may defer the payment of land tax for 6 months if the landowner or vested beneficiary is unable to meet this requirement because either:

- they started occupying the land on or after 1 July of the year before the assessment

- the land was purchased on or after 1 July of the year before the assessment and they did not start living on it in the year before the assessment.

After that 6-month period, provided the land has been continuously used as a PPR by an individual owner or vested beneficiary, an exemption will apply to that land for the relevant assessment year.

Example 1

Jorge uses land as his PPR for 6 months in a row from 1 September 2024 to February 2025. The land is exempt for the 2025 assessment year.

Example 2

Wei-Ai bought a property in November 2024, but only started living in it on 2 February 2025. By 2 August 2025, she had used the land as her PPR for 6 months in a row. The land is exempt for the 2025 assessment year if she did not live in another home that is exempt as her PPR.

If you need to defer your land tax assessment until you can live on the land for 6 months in a row, call us on 13 21 61 (have your assessment ready).

Exemptions for more than one property

The PPR exemption may be available for more than one property in limited situations, as outlined below.

Exemption for land next to your PPR

The exemption can extend to adjoining land owned by the individual owner or eligible trustee which is on a separate title. To qualify, the adjoining land must:

- touch the PPR land or be separated by only a road, railway or something similar that you can reasonably move around or across.

- not contain a separate residence

- add value to the PPR land

- be used solely for the private benefit and enjoyment of the individual owner or the vested beneficiary living on the PPR land.

A separate residence is a building on the land that can be lived in on its own. So, if the adjoining land has a house or granny flat, the exemption cannot apply. A building without all the features of an ordinary home, such as kitchen and bathroom facilities, is not considered a separate residence for this exemption.

Examples that may qualify for this exemption include adjoining land with a pool, tennis court or garden, provided there is no separate residence.

Example

Patel owns lot 1 and lot 2, which are next to each other on separate titles. Her residence is built on lot 1 and therefore only lot 1 is eligible for the exemption. Lot 2 may be eligible for exemption if it meets the conditions for land next to next to the PPR.

From 1 January 2020, this exemption is limited to:

- land that is next to your PPR if both are located entirely in regional Victoria

- where an apartment or unit in metropolitan Melbourne that is a PPR has a separately titled car park and/or storage space, the exemption may also apply to that car park and/or storage space.

Metropolitan Melbourne

If your PPR is in metropolitan Melbourne, the exemption only applies where your PPR is an apartment or unit with a separately-titled car park and/or storage space.

From the 2020 land tax year, we assess the adjoining land for land tax unless you have combined the land with your PPR and the adjoining land into a single title.

For more information about combining land titles, contact Land Use Victoria.

Regional Victoria

If your PPR and the adjoining land is wholly in regional Victoria, these changes will not affect you. The exemption still applies.

If your PPR is in regional Victoria, and you have multiple adjoining lands inside and outside of regional Victoria, the exemption will only apply to those lands wholly in regional Victoria.

Regional Victoria means the regional councils listed below and the 6 alpine resorts of Mt Baw Baw, Mt Buller, Mt Hotham, Mt Stirling, Falls Creek and Lake Mountain.

- Alpine Shire Council

- Ararat Rural City Council

- Ballarat City Council

- Bass Coast Shire Council

- Baw Baw Shire Council

- Benalla Rural City Council

- Buloke Shire Council

- Campaspe Shire Council

- Central Goldfields Shire Council

- Colac Otway Shire Council

- Corangamite Shire Council

- East Gippsland Shire Council

- Gannawarra Shire Council

- Glenelg Shire Council

- Golden Plains Shire Council

- Greater Bendigo City Council

- Greater Geelong City Council

- Greater Shepparton City Council

- Hepburn Shire Council

- Hindmarsh Shire Council

- Horsham Rural City Council

- Indigo Shire Council

- Latrobe City Council

- Loddon Shire Council

- Macedon Ranges Shire Council

- Mansfield Shire Council

- Mildura Rural City Council

- Mitchell Shire Council

- Moira Shire Council

- Moorabool Shire Council

- Mount Alexander Shire Council

- Moyne Shire Council

- Murrindindi Shire Council

- Northern Grampians Shire Council

- Pyrenees Shire Council

- Borough of Queenscliff

- South Gippsland Shire Council

- Southern Grampians Shire Council

- Strathbogie Shire Council

- Surf Coast Shire Council

- Swan Hill Rural City Council

- Towong Shire Council

- Wangaratta Rural City Council

- Warrnambool City Council

- Wellington Shire Council

- West Wimmera Shire Council

- Wodonga City Council

- Yarriambiack Shire Council

Purchase of a new PPR

A dual PPR exemption is available where an individual owner or eligible trustee purchases new land to be used as a PPR. As at 31 December of the year before the assessment year, the owner or vested beneficiary still lives in their existing PPR.

In these circumstances, both the new PPR and old PPR are exempt from land tax for that assessment year. However, the owner or trustee cannot earn any income from the new PPR while it is not occupied as their PPR in the year before the tax year.

The additional exemption for the new PPR may be cancelled if the individual owner or vested beneficiary does not move into the new PPR within 12 months of buying it. They must also live in it as their PPR for at least 6 months in a row.

The exemption applies to newly purchased land with existing residences as well as vacant land where the owner plans to build a new residence to be used and occupied as a PPR within 12 months of buying the land. This planned construction applies only in very limited circumstances. An owner must complete constructions and move in within 12 months of purchase before applying. If you do not move in within 12 months, you must notify us.

Sale of an old PPR

A dual PPR exemption is also available where an individual owner or vested beneficiary has moved into a new PPR but, as at 31 December of the year before the assessment year, still owned the old PPR.

In this case, both the old and new PPR are exempt for that assessment year even though the owner or beneficiary is no longer living in the old PPR.

The individual owner or trustee cannot earn any income from the old PPR land while it is not their PPR in the year before the tax year. The exemption may be cancelled if the old PPR has not been sold by the end of the assessment year which the exemption applies to.

Partial exemptions

Partial exemption if land is used for business purposes

If part of your PPR is also used for a substantial business activity, that part is not exempt from land tax.

We will calculate how much of the property is used for living and how much is used for business based on either the floor space of a building or land area. We may ask the Valuer-General to help decide the split.

For more detail and examples, refer to revenue ruling LTA.001.

Partial exemption if a separate residence on PPR land is leased

If your PPR includes a separate residence on the same title, such as a granny flat or bungalow, which was rented out to earn income in the previous tax year, you will pay land tax on that part of the land. You will still get the PPR exemption for the rest of the land.

The PPR exemption will continue to apply to the whole land if a family member merely contributes towards things like utility costs, maintenance and repairs. These payments do not count as ‘rental income’.

Partial exemption for trustees

Where only some of the vested beneficiaries of the trust live at the property, an exemption will not apply to the whole land. It will only apply to the percentage part which the resident beneficiary owns and uses as their home.

To qualify, the beneficiary must:

- live at the property as their PPR

- not pay rent to the trustee.

Example

Mark and Nicola are the vested beneficiaries in the Red House under a fixed trust. They have equal interests. Only Mark lives there. He is entitled to a land tax exemption on his 50% share of the value of the Red House. Nicola is not entitled to a land tax exemption on her share of the Red House.

Meaning of income

We use the ordinary meaning of the word ‘income’ for this exemption. We decide if a payment is income by looking at each case separately. No single factor determines if a payment is income. We look at things like:

- whether an arrangement is meant to make profit

- the relationship between the parties involved

- how large the payments are.